Business Cycle Stages: A Comprehensive Guide to Its Stages

- surajit bhowmick

- Feb 22, 2025

- 3 min read

In this article, we're going to understand the concepts of the business cycle. The Business Cycle is usually interchangeably used with the journey of building a Business but both are different things. First, let's understand both this concept in a nutshell and later on we'll deep drive in detail a discussion of the Business Life cycle and what are the different stages.

Meaning of Business Cycle Stages and Building a Business: The business cycle explains the natural rise and fall of economic activity, while the process of business growth shows how a simple idea can evolve into a thriving product.

So let's cover this topic

The Business Cycle: The Heartbeat of the Economy

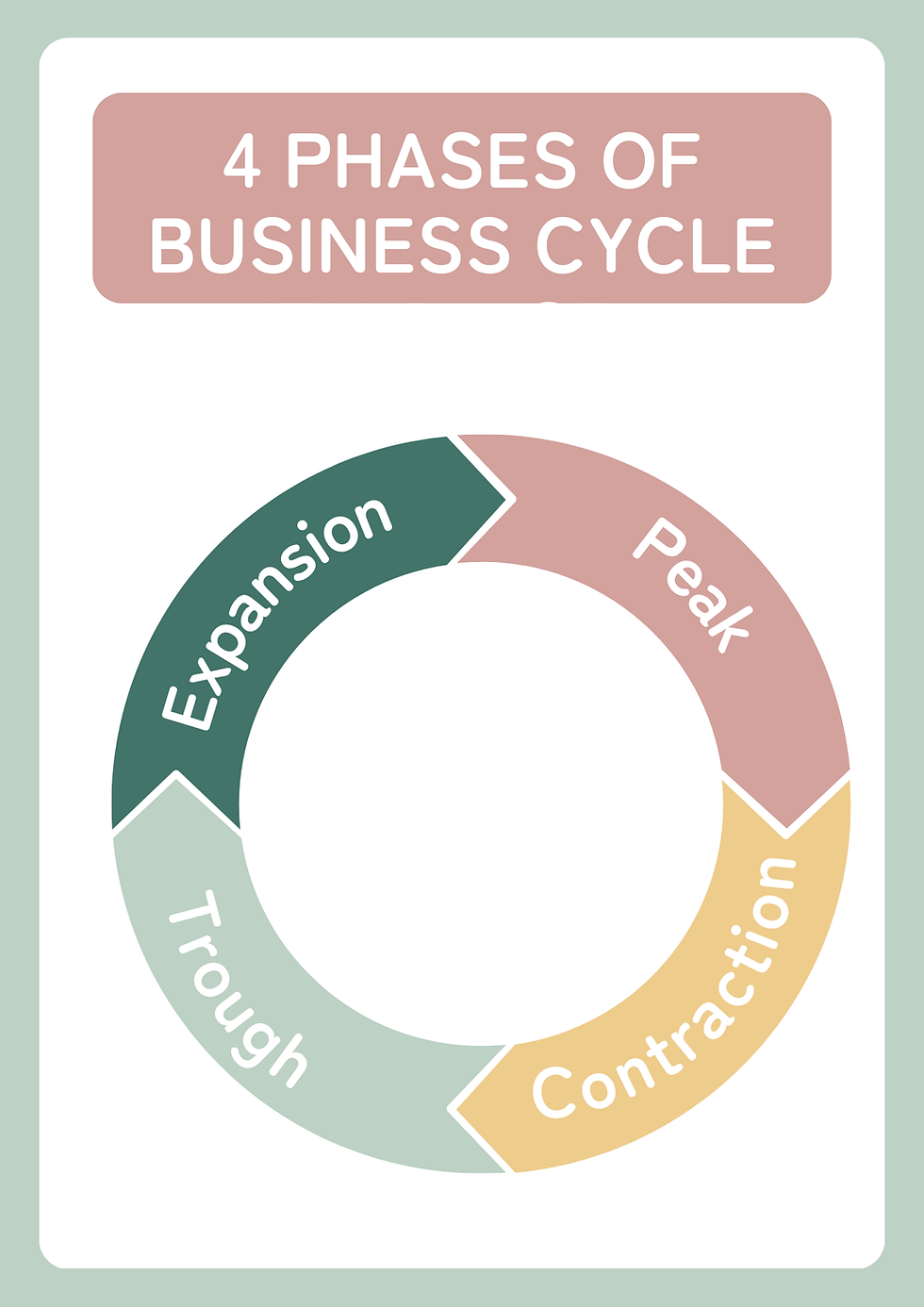

The business cycle also known as the economic cycle, is like the heartbeat of an economy. It represents where the country's economy is moving through four key stages: Expansion, Peak, Contraction, and Trough. So let's understand each concept in detail.

Expansion: The Growth Phase

During this phase, the economy is on the rise. Businesses are growing, people are spending more, and jobs are being created.

How to identify the economic expansion phase?

Gross Domestic Product (GDP), employment rates, and consumer confidence are some of the key indicators. When all this indicator moves upwards then we can say that the economy is in the expansion phase. It's a time of opportunity.

What challenges does the economy face during the expansion phase?

In this stage, demand is usually high which can lead to low supply, and a combination of this situation can lead to inflation.

Peak: The High Point

This is the point where economic activity reaches its maximum level it is the top of the mountain. In this stage it seems like everything is going well but as they say in Hindi "daal mein kuch kaala hai" which means something is wrong. Inflation may rise too quickly, or businesses might overproduce, leading to excess inventory.

How to identify the economic peak phase?

Businesses may start to cut back on spending, and consumers become more cautious.

What challenges does the economy face during the peak phase?

The risk of a downturn increases as imbalances in the economy become more apparent.

Contraction: The Downturn

This phase is often referred to as recession in which economic activity declines. In the contraction phase GDP shrinks, unemployment rises, and consumer spending drops. Even businesses may lay off workers, reduce production and delay investments.

How to identify the economic contraction phase?

Consumers start spending low and confidence drops. Businesses focus on survival rather than growth. These are some of the indicators along with some of the reasons mentioned above.

What challenges does the economy face during the contraction phase?

Prolonged recessions can lead to widespread job losses and financial hardship for many.

Trough: The Bottom of the Cycle

This is the lowest point of the business cycle, where economic activity stabilizes before starting to recover. It’s like the calm after the storm. In this stage, things fell tough, but signs of improvement began to emerge.

How to identify the economic trough phase?

Businesses start to see opportunities again, and consumers regain confidence. The economy begins its journey back to expansion.

What challenges does the economy face during the trough phase?

Recovery can be slow, and it may take time for businesses and consumers to fully bounce back.

Have you observed a common thing that every stage has its challenges? It is just because of "Darr Ke Aage Jeet Hai" 😅. Just joking!

Now let's see

How Long Does a Business Cycle Last?

There are no fixed timelines. If you see the average usually business cycle lasts between 5 to 7 years. Let's understand this with real-life examples.

One of the longest contractions which lasted nearly a decade was the Great Depression (1929-1939), while the 2008 Financial Crisis led to a severe but shorter recession. As we all know the most recent and unique recession COVID-19 recession was sudden and sharp but it was followed by a rapid recovery.

From the above examples, I concluded that recovery depends on many factors such as technological advancements, government policies, and global events.

Historical Examples of Business Cycles

The Great Depression (1929-1939)

The Dot-Com Bubble

The 2008 Financial Crisis

The COVID-19 Recession

These are some of the historical examples, if you want a detailed article on this please comment down below.

Comments